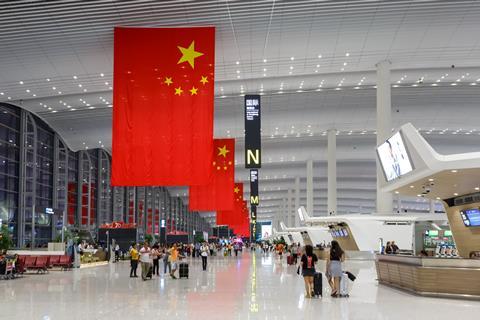

A new report from Alton Aviation Consultancy suggests that China’s airline sector is facing longer recovery than expected, due to “domestic economic challenges” like weak consumer demand.

The report, which covers the aviation outlook for 2025, notes that while China and India are Asia-Pacific’s “twin engines of growth”, it is “unlikely” for China to fully recover in 2025.

China’s attempts at wooing inbound travellers by waiving visa requirements “has not yet fully realised its intended impact”, the Alton report adds.

While China’s domestic traffic has already surpassed pre-pandemic 2019 levels, its international recovery has been tepid at best. Alton estimates recovery – as at end-2024 – to only be at around 70% that of 2019 levels.

On the other hand, India has seen demand for international and domestic traffic surpass pre-pandemic levels.

“A growing middle class and increasing affordability of air travel, fuelled by increasing low-cost carrier penetration, are key drivers of this optimistic outlook,” the consultancy adds.

The merger between Air India and Vistara, which wrapped up in November 2024, will “bring more stability” to the Indian airline sector, though the Alton report warns of an “intensifying” competitive landscape between the newly-enlarged Air India and low-cost rival IndiGo, as they “make forays into each other’s core markets”.

In its outlook for the global aviation market, Alton flags supply chain woes and labour issues as “prime” challenges in 2025, even as the sector “continues its post-pandemic recovery march”.

“[Airlines] continue to see their near-term capacity expansion plans being held back by delivery delays and long maintenance turnarounds, while also grappling with labour shortages like the rest of the aviation industry,” the report states.

The “lingering impacts” of the Covid-19 pandemic remains in the supply chain, and could likely take years to be resolved, adds Alton.

To this end, the consultancy says the aviation sector needs “more comprehensive solutions” to address “the structural nature of many supply chain issues”. These include talent retention, investment in technology, as well as the diversification of supply chains.

“For airlines in particular, the focus is also on how to maximise the use of aircraft resources – reducing turnaround times or optimising schedules in order to increase daily utilisation,” the consultancy adds.