Pressure from Elliott Investment Management has forced change at Southwest Airlines, which is now planning a major overhaul of the company’s board of directors.

Six directors on the 15-member board will retire in November, Southwest disclosed on 10 September, while executive chairman and former chief executive Gary Kelly will retire following Southwest’s annual meeting in 2025.

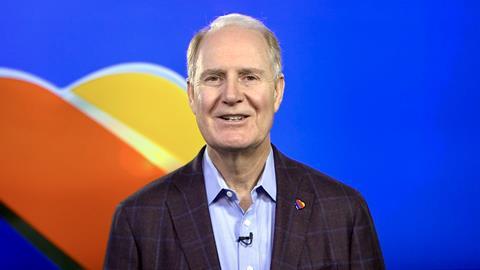

Southwest’s board emphasised its continuing support of current CEO Bob Jordan, maintaining that it is ”confident that there is no better leader… to successfully execute Southwest Airlines’ robust strategy to evolve the airline and enhance sustainable shareholder value”.

The six resigning directors are to include David Biegler, Veronica Biggins, US Senator Roy Blunt, William Cunningham, Thomas Gilligan and Jill Soltau. Southwest expects the board to be reduced to 13 members following the exodus.

In a 10 September letter to shareholders, Kelly said that the decisions come following a recent meeting in New York with Elliott, a hedge fund that holds 11% of Southwest’s outstanding stock. Elliot in recent months has pushed fiercely for Southwest to make major changes to its senior leadership team, including replacing Kelly and Jordan.

The company’s board plans to appoint four new directors, “potentially including candidates proposed by Elliott”, Southwest says. Elliott had previously suggested 10 candidates with strong airline experience, including former airline chiefs David Cush and Gregg Saretsky.

“In our experience, this is unprecedented,” Elliott says in response to Southwest’s plan to overhaul its board of directors. ”We are pleased that the board is beginning to recognise the degree of change that will be required at Southwest, and we hope to engage with the remaining directors to align on the further necessary changes.

”The need for thoughtful, deliberate change at Southwest remains urgent, and we believe the highly qualified nominees we have put forward are the right people to steady the board and chart a new course for the airline,” Elliot adds.

Southwest has appointed eight new board directors over the past three years, including the recent addition of Rakesh Gangwal, co-founder of India’s InterGlobe Aviation.

”Inclusive of all of these changes, 75% of the airline’s directors will have three years or less tenure on the board as of the 2025 annual meeting and the average board tenure will be approximately 2.5 years, reduced from 7.3 today,” Southwest says.

Additionally, the company has eliminated its executive committee structure and created a new finance committee focused on oversight of “financial, operational and business plans and strategies” in addition to major transactions. The new committee will include both incumbent and incoming directors.

In his letter to shareholders, Kelly describes Southwest as ”unquestionably the most successful commercial carrier in the history of aviation”.

“From my perspective since joining in 1986 as controller, the company’s value has grown 60 fold,” Kelly notes. ”It had an unprecedented, uninterrupted profit streak of 47 years – despite wars; recessions; oil price spikes; 9/11; the Great Recession, and all along, an airline environment so brutally competitive that every major airline in existence in 1986 other than Southwest is either gone or has gone bankrupt.”

The company’s decades-long streak of profitability was broken by the Covid-19 pandemic, and Southwest has struggled to regain its former status as the airline industry has broadly recovered. Elliott has previously noted that Southwest “represents the most compelling airline turnaround opportunity in the last two decades”.