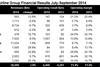

ANALYSIS: Financial fortunes mixed for Europe's carriers

On the face of it European airline fortunes for the third quarter of the calendar year was a case of business as usual.

Keep reading this article by becoming a FlightGlobal member now

PLEASE REGISTER FOR FREE OR SIGN IN TO CONTINUE READING

You have reached your limit of free articles for this period. Register for a FREE account to read this article and benefit from:

- Increased access to online news and in-depth articles from:

- FlightGlobal Premium covering the global aviation industry

- Airline Business providing insight for business leaders

- Weekly newsletters on topics across the industry